Car title loans Lufkin TX offer quick cash secured by vehicle titles, with flexible repayment terms and online applications for residents. Refinancing is possible with direct lenders, avoiding credit checks but requiring vehicle inspection for fairness. Researching specialists and applying online streamlines the process, providing better rates and saving time compared to traditional methods.

Looking to refinance your car title loan in Lufkin, TX? This guide is your roadmap. We break down the process step-by-step, starting with understanding car title loans in Lufkin and their unique features. Next, we outline the eligibility criteria for refinancing, helping you determine if it’s the right move. Finally, we simplify the refinance process, offering practical tips to make your transition smooth and hassle-free. Take control of your finances today!

- Understanding Car Title Loans Lufkin TX

- Eligibility Criteria for Refinancing

- Simplifying the Refinance Process

Understanding Car Title Loans Lufkin TX

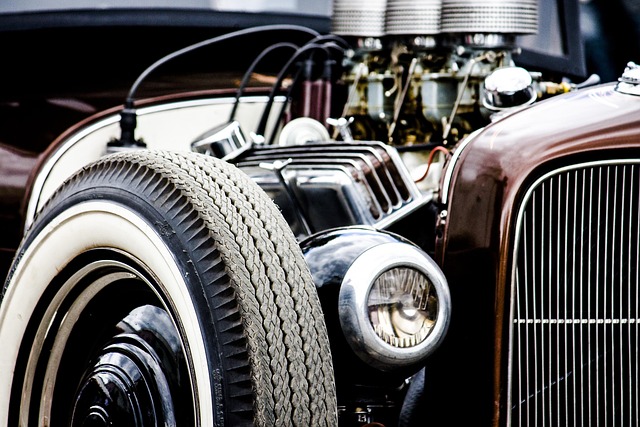

Car title loans Lufkin TX are a type of secured lending where individuals use their vehicle’s title as collateral to borrow money. This option is popular among those needing quick access to cash, especially in emergencies or when traditional banking options are limited. The process involves providing the lender with your car’s registration and title, and in return, you receive a loan amount based on your vehicle’s value.

Lufkin TX offers a range of repayment options for these loans, allowing borrowers to choose terms that suit their financial comfort level. Typically, repayment periods can vary from several months to a year or more. Interestingly, with the advancement of technology, many lenders now offer online applications for car title loans, making the process even more accessible and convenient for potential borrowers in Lufkin.

Eligibility Criteria for Refinancing

When considering refinancing your Car title loans Lufkin TX, it’s important to understand the eligibility criteria to ensure a smooth process. Lenders will assess your current loan balance, the value of your vehicle, and your ability to repay the new loan. Since car title loans are secured by your vehicle, maintaining good care and ensuring it has minimal damage can increase your chances of approval. Additionally, lenders often require proof of income and employment verification to guarantee repayment capability.

Unlike traditional loans, Car title loans Lufkin TX and San Antonio Loans don’t typically involve a credit check, making them an attractive option for those with poor or no credit history. However, the absence of a credit check doesn’t mean the lender won’t perform a vehicle inspection to assess its condition and determine the loan-to-value ratio. This inspection is crucial in evaluating the outstanding balance against the vehicle’s current market value, ensuring both parties receive a fair deal.

Simplifying the Refinance Process

Refinancing your Car Title Loan in Lufkin, TX, can be a straightforward process when you know where to start. Many direct lenders offer simple and accessible services, allowing you to explore better rates and terms for your existing loan. The initial step is to research reputable lenders who specialize in car title loans San Antonio Loans; this ensures you’re dealing with professionals who understand the unique aspects of these loans.

An Online Application is typically the first port of call; it’s quick, secure, and often the gateway to a faster refinance process. By filling out an application online, you can provide essential details about your current loan and vehicle, enabling lenders to assess your eligibility for a lower interest rate or more flexible payments. This modern approach streamlines the entire refinance journey, saving you time and effort compared to traditional methods.

Car title loans Lufkin TX can be a convenient financial solution, but refinancing offers an opportunity to improve your terms and save money. By understanding the eligibility criteria and simplifying the refinance process, you can easily navigate this option in Lufkin, TX. Remember that, when done right, refinancing can lead to lower interest rates, extended repayment periods, and more manageable monthly payments, making it a valuable tool for managing your debt.