Car title loans Lufkin TX provide quick financial support secured by vehicles but carry risks like loss of ownership if not repaid on time. High-interest rates compare unfavorably to alternatives. Responsible borrowing requires dealing with licensed lenders, understanding clear terms, and considering flexible payment plans to avoid penalties. Timely repayments are crucial for maintaining financial control.

Are car title loans Lufkin TX a viable financial option? This article explores the ins and outs of these secured loans, focusing on Lufkin, TX. We delve into ‘Understanding Car Title Loans’ to uncover how they work and the potential benefits and risks involved. Furthermore, we guide readers through ‘How to Secure a Car Title Loan Safely’, ensuring informed decisions. By weighing the options, you can determine if car title loans Lufkin TX are the right choice for your short-term financial needs.

- Understanding Car Title Loans in Lufkin TX

- Benefits and Risks: Weighing Your Options

- How to Secure a Car Title Loan Safely?

Understanding Car Title Loans in Lufkin TX

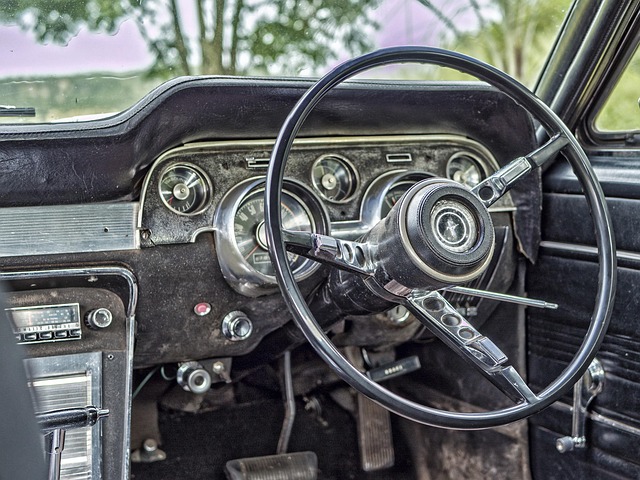

Car title loans Lufkin TX have gained popularity as a fast and accessible way for individuals to secure funding. This loan type is secured by the borrower’s vehicle, typically a car or truck, which acts as collateral. Lenders in Lufkin TX offer these loans based on the value of the vehicle, with the process often being quicker than traditional loan applications. The simplicity and speed are appealing to those needing immediate financial support, such as covering unexpected expenses or debt consolidation.

In the context of debt consolidation and loan refinancing, car title loans can provide a solution for Lufkin TX residents looking to manage multiple debts or secure better interest rates. Payment plans for these loans are usually structured around the borrower’s ability to repay within a set period, often with higher monthly payments but potentially lower overall interest compared to other short-term financing options. However, borrowers must be mindful of the potential risks, including the possibility of losing their vehicle if they fail to meet loan obligations.

Benefits and Risks: Weighing Your Options

Car title loans Lufkin TX can provide a quick solution for those needing emergency funding. These loans are secured by the value of your vehicle, offering potential borrowers an accessible way to gain financial resources without traditional credit checks. With just a clear car title and a few basic requirements, individuals can apply for these loans, making them appealing for many in need of fast cash.

However, like any borrowing option, there are risks associated with car title loans Lufkin TX. The primary concern is the potential loss of your vehicle if you fail to repay the loan. This process involves a title transfer, which could leave you without ownership of your asset if repayments aren’t met. Moreover, these loans often come with high-interest rates and fees, making them more expensive than other short-term funding options, such as Houston title loans. Weighing these benefits and risks is crucial before deciding whether a car title loan is the right choice for your emergency funding needs.

How to Secure a Car Title Loan Safely?

When considering a car title loan in Lufkin, TX, prioritizing safety is paramount to protect your asset and financial well-being. Firstly, ensure that you deal only with reputable lenders who have a proven track record and are licensed to operate in Texas. Reputable lenders will provide transparent terms and conditions, outlining the interest rates, fees, and repayment schedule clearly. This transparency helps you understand the full cost of borrowing and make informed decisions.

Additionally, focus on flexible payments to manage your debt comfortably. Many car title loan providers offer personalized repayment plans that align with your income cycle, making it easier to stick to the agreed-upon schedule. A financial solution like this can help avoid default or late payments, which often come with harsh penalties. Remember, responsible borrowing and timely repayments are key to maintaining control over your finances while utilizing a car title loan as a short-term financial solution.

Car title loans Lufkin TX can be a viable option for those in need of quick cash, but it’s crucial to approach them with caution. By understanding the process, evaluating the benefits and risks, and securing a loan responsibly, individuals can make informed decisions. While these loans offer accessibility, they come with potential drawbacks, so borrowers must weigh their financial situation carefully before proceeding. Navigating this option requires thorough research and a commitment to protecting one’s assets.